Why are homeowners insurance premiums more expensive than renters insurance? 2026 data, side‑by‑side comparisons, savings steps, and FAQs — get a quote now.

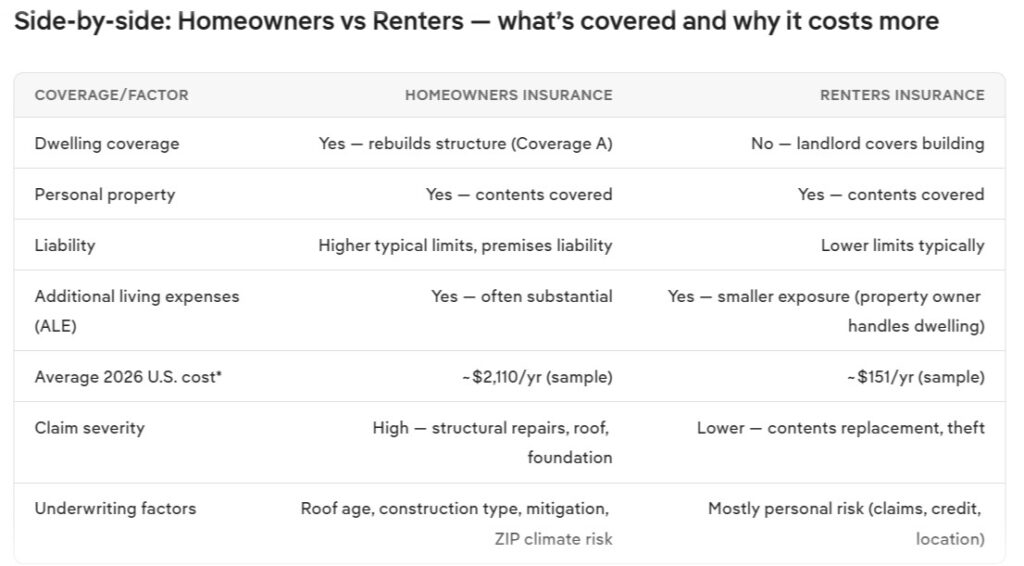

Homeowners insurance premiums are typically several times higher than renters insurance. In 2026 the U.S. benchmark shows homeowners averaging roughly $2,100/year (for common dwelling limits) versus about $150/year for renters policies.

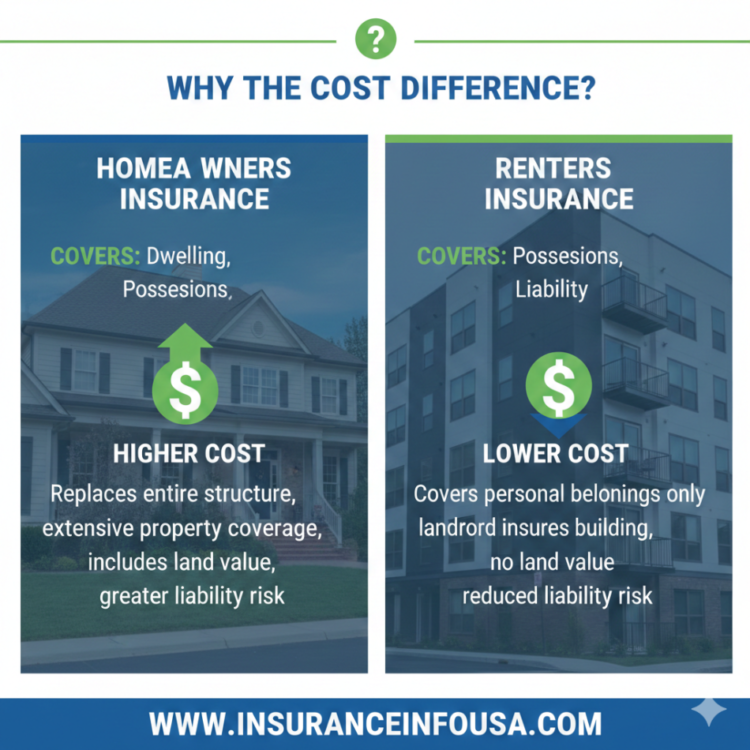

The difference comes down to who pays to rebuild, higher liability exposure, climate and replacement‑cost inflation, and more granular underwriting.

This guide explains the drivers, shows provider comparisons, gives a step‑by‑step buyer’s guide, highlights 2026 trends (AI, climate, reinsurance) and answers common FAQs so you can compare quotes and lower your cost.

Quick snapshot: 2026 average costs (U.S.)

- Average homeowners insurance (2026 benchmark): ~ $2,110/year for typical dwelling coverage.

- Average renters insurance (2026 benchmark): ~ $151/year (~$13/mo) for standard personal property limits.

- Historical context: homeowners premiums have outpaced renters for years; post‑2018 catastrophe losses and 2020–2025 replacement cost inflation widened the gap.

Do you need homeowners insurance if you have a mortgage?

Core reasons homeowners premiums are higher

1) Dwelling (structural) coverage vs personal property only

Homeowners policies insure the dwelling — the physical structure and permanent systems — often the largest single asset a family owns.

Rebuilding costs after a covered loss can be tens to hundreds of thousands of dollars. Renters insurance covers personal property and liability only; the landlord insures the building.

2) Larger claim severity and catastrophe exposure

Homeowners claims are higher severity: roof replacement, structural repairs, foundation work. Catastrophic events (hurricanes, wildfires, major storms) produce large payouts and push insurers to raise rates or tighten underwriting. ZIP‑level climate risk pricing has become common, increasing premiums in exposed areas.

3) Replacement cost inflation and construction input increases

Construction materials and labor costs surged during 2020–2025 and remain elevated into 2026. Replacement cost inflation means insurers expect higher claim payouts, so premiums rise to cover expected losses plus reinsurance expenses.

4) Greater liability exposure and additional coverages

Homeowners face higher premises liability (guests, pools, home businesses). Home policies also include Additional Living Expenses (ALE) coverage when a home is uninhabitable — potentially large payouts that renters policies don’t trigger the same way.

5) Underwriting complexity and property‑level risk factors

Insurers price homeowners risks on property specifics (roof age/material, foundation type, building codes, nearby vegetation, flood/wind exposure). That granular risk assessment increases both administrative cost and pricing for higher‑risk homes.

6) Reinsurance, market capacity and regulatory effects

Insurers buy reinsurance to manage catastrophe exposure. After loss years, reinsurance becomes more expensive or limited, and those costs are passed to retail premiums. In some states insurers retreat from high‑risk ZIPs, reducing competition and increasing local prices.

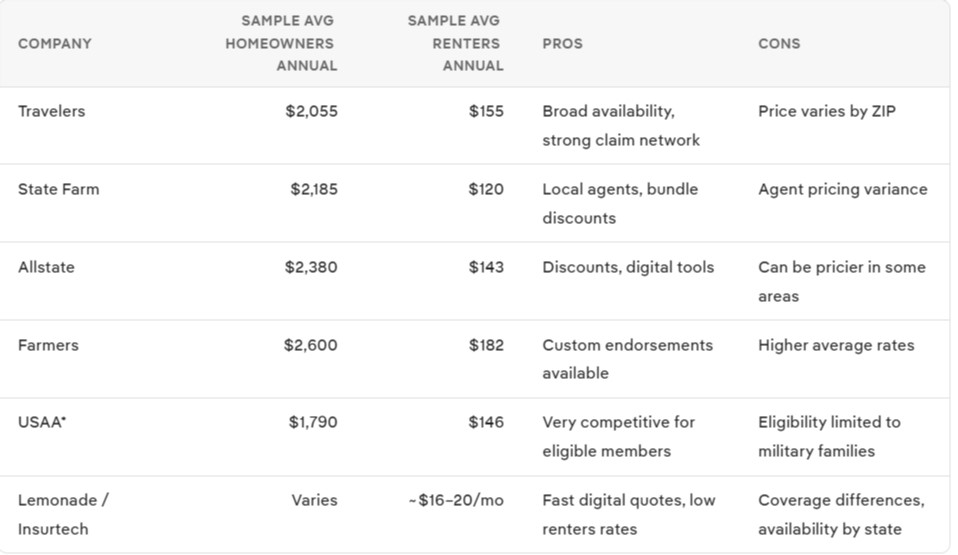

Top providers — sample comparison (illustrative averages and pros/cons)

Values shown are illustrative summaries using 2025–2026 industry averages; always request quotes with identical coverage levels.

Sources and methodology: company averages from public 2025–2026 comparisons; per‑policy pricing varies by ZIP, dwelling limit, deductible and claim history.

Buyer’s guide: Step‑by‑step to compare and lower costs

- Calculate dwelling replacement cost (not market value). Use local rebuild cost per sq. ft. or insurer estimator; this sets Coverage A.

- Inventory personal property — list items with photos, receipts and serial numbers for scheduled items (jewelry, electronics).

- Compare apples‑to‑apples: ensure dwelling limits, deductibles, coverage types (replacement cost vs actual cash value), and liability limits match when comparing quotes.

- Increase your deductible sensibly — a higher deductible reduces premium but raises out‑of‑pocket on claims. Common changes from $1k to $2.5k yield meaningful savings.

- Use discounts: bundle home and auto, install security systems, update wiring/plumbing, maintain roof. Check insurer‑specific mitigation discounts (hurricane shutters, fortified programs).

- Mitigate hazard exposure: add fire‑resistant landscaping, roof hardening, and water‑leak sensors to reduce risk and qualify for discounts.

- Shop annually and use multiple channels: captive agents, independent agents, direct carriers, and insurtech platforms for fastest quotes.

- Consider supplemental policies where needed: flood (NFIP or private), earthquake, sewer backup endorsements. These are often excluded in standard homeowners policies.

- For renters: confirm landlord’s building coverage; choose adequate personal property and liability limits and consider replacement cost vs actual cash value for contents.

2026 updates & trends that affect premiums

AI and automation in underwriting and claims

Insurers increasingly use AI, drones, satellite imagery and predictive tools for faster inspections and more granular underwriting. This can reduce pricing for low‑risk properties but may surface vulnerabilities that increase premiums. Regulatory bodies require human oversight and transparency in many states.

Climate and ZIP‑level risk pricing

Post‑2023 modeling changes pushed ZIP‑level pricing: carriers now price to local flood, wildfire, wind and storm risk. Homes in high exposure ZIPs face higher rates or limited coverage options.

Reinsurance and capital market volatility

Higher catastrophe losses tighten reinsurance capacity and raise prices. Insurers pass these costs to consumers through rate filings, especially in coastal and wildfire‑prone regions.

Product innovation and resilience incentives

Insurers offer resilience/mitigation discounts for FORTIFIED standards, wildfire hardening and approved retrofits. Parametric and usage‑based products are emerging for specific risks.

How location and state rules change the picture

- Flood is excluded from standard homeowners policies — source flood insurance separately (NFIP or private).

- States with high homeowner premiums typically include Florida, Louisiana, Texas and some Western wildfire zones (storm and wildfire exposure plus regulatory/market constraints).

- State rules on credit scoring and underwriting (e.g., some restrictions) change rates; where insurers cannot use credit or prior claims as freely, rating patterns shift accordingly.

Checklist: When to shop and what to bring to a quote

- Home address and year built

- Square footage and rebuild cost estimate (or allow insurer estimator)

- Roof age and type, recent updates (HVAC, electrical, plumbing)

- Loss history (past 5–10 years) and claim details

- Inventory of valuable items and receipts/serials

- Desired deductible and liability limit

Practical tips to lower homeowners premiums (actionable)

- Get multiple quotes and verify identical dwelling limits and deductibles.

- Increase your deductible where financially feasible.

- Bundle home and auto with the same insurer.

- Invest in mitigation (roof, shutters, fire‑resistant landscaping) and get proof for discounts.

- Maintain claims discipline — small claims can cost more in future premiums than paying out of pocket.

- Consider policy endorsements wisely (e.g., scheduled jewelry) to avoid losing coverage or facing low sublimits.

Conclusion

Homeowners insurance is more expensive because it covers rebuilding costs, larger liability exposures and faces climate‑driven and replacement‑cost inflation that renters policies do not.

Use the checklist and buyer’s guide above: calculate true replacement cost, compare like‑for‑like quotes, invest in mitigation where effective, and shop at renewal. Get at least three quotes today to find the best combination of coverage and price.

FAQs

Why is home insurance more expensive?

Because it covers the structure (rebuilding costs), higher liability, and larger claim severity; climate risk, replacement‑cost inflation, and reinsurance add to premiums.

What are the disadvantages of renter’s insurance?

Limited to personal property and liability only (not the building), sublimits for high‑value items unless scheduled, and coverage gaps like flood or earthquake.

What are reasons people typically do not get renters insurance?

Perceived low value, low cost of replacement, belief landlord’s policy covers them, lack of awareness, and procrastination.

Can I get renters insurance if I own my home?

No — renters insurance is for tenants. If you own the home, you need homeowners insurance; a condo owner needs a HO‑6 policy.

How much more is landlord insurance than homeowners?

It varies; landlord (dwelling for rent) policies can be similar or slightly higher than homeowners due to rental exposures and different coverages—compare quotes for exact figures by state and property.

What is the main reason someone would want to have and need to have renters insurance?

To protect personal belongings and provide liability coverage at a low cost if theft, fire, or accidents occur in the rental.

Homeowners renters insurance definition

“Homeowners insurance” covers the dwelling, personal property, liability and ALE for owner‑occupied homes. “Renters insurance” covers a tenant’s personal property and liability; the landlord insures the building.

Do I need renters insurance if I have homeowners insurance?

No — homeowners insurance covers owner‑occupied property. Renters insurance is unnecessary if you truly own and occupy the home; tenants need renters insurance because the landlord’s policy won’t cover their belongings.

Is landlord insurance more expensive than homeowners reddit?

On Reddit you’ll see mixed reports: sometimes landlord insurance is more expensive due to rental risk, sometimes similar or cheaper depending on location, property condition and coverage. Always compare quotes rather than rely on anecdotes.

What is the main reason someone would want to have and need to have renters insurance?

Main reason: low‑cost protection for your personal property and liability—covers replacements and legal costs if you’re liable for damages or injuries in your rental.