Discover the best pet insurance companies for dogs in the USA for 2026. Compare top providers like Spot, Lemonade, and ASPCA on coverage, costs ($30–$100/month), and ratings. Get free quotes to protect your pup today!

Best Pet Insurance Companies for Dogs USA

Rising vet bills make pet insurance essential for dog owners. With average claims exceeding $3,000 for emergencies, the best pet insurance companies for dogs USA offer reimbursement up to 90% on accidents, illnesses, and more. This guide compares top providers using 2026 data to help you choose wisely.

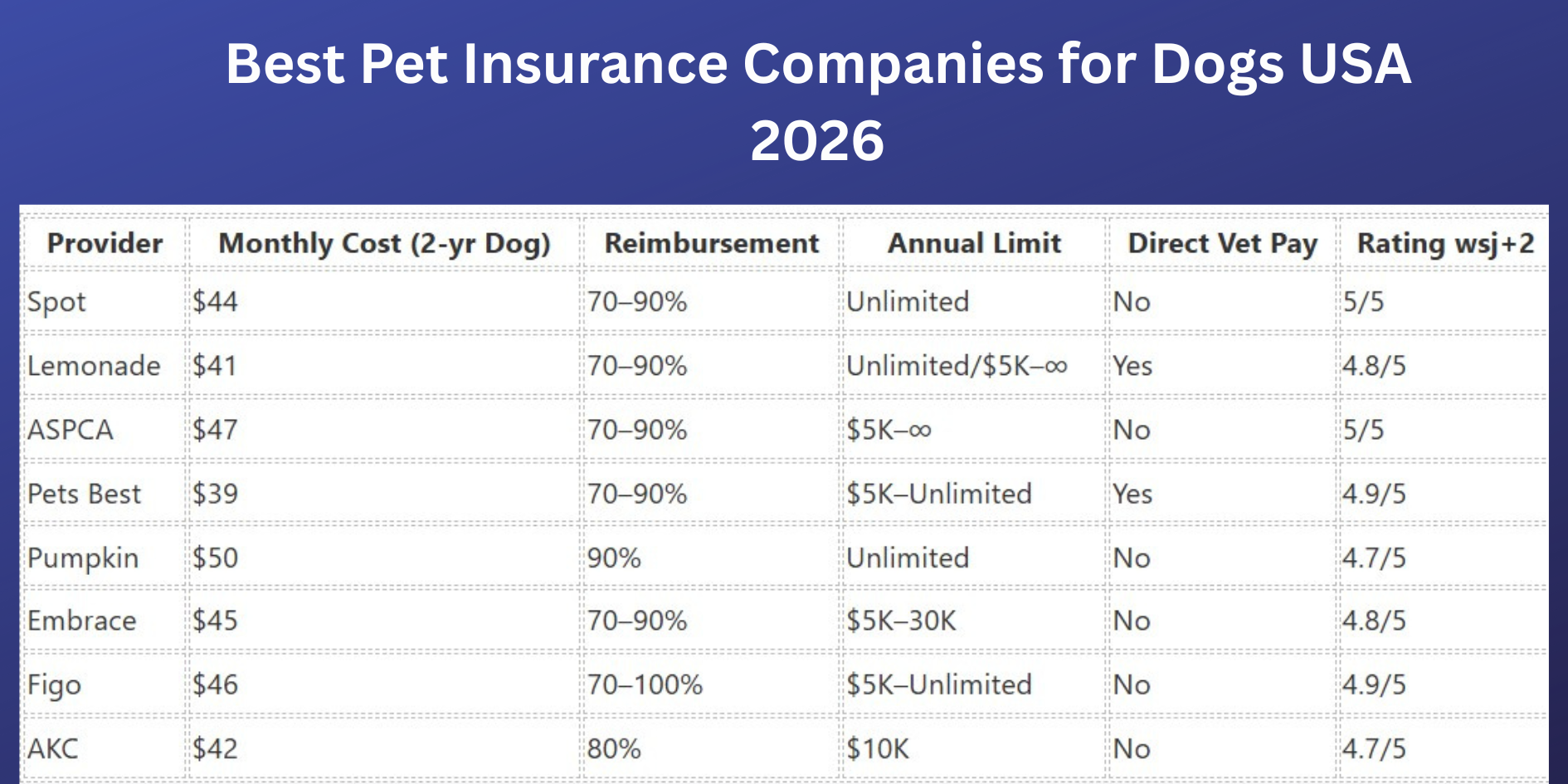

Top 8 Best Pet Insurance Companies for Dogs USA

These eight companies consistently rank at the top of 2026 lists from Money, NerdWallet, MarketWatch, and other reviewers thanks to strong coverage, fair pricing, and solid customer satisfaction. Below you’ll find more detail on how each one treats dogs specifically, including real-world pros and cons.money+2

1. Spot – Best for Unlimited Coverage

Spot is frequently highlighted as one of the best options for dog owners who want unlimited annual coverage and very flexible plan design. Money names Spot “Best for Unlimited Coverage,” and comparison sites note that it’s one of the few brands consistently offering unlimited annual limits across many quotes.pawlicy+1

-

Typical cost for dogs: Around $40–$60 per month for accident-and-illness coverage for a young mixed-breed dog, depending on your zip code, deductible, and reimbursement level.

-

Coverage highlights: Accidents, illnesses, hereditary and congenital conditions, chronic conditions, cancer, diagnostic tests, prescription meds, and optional wellness add-ons in many states.

-

Customization: Deductibles often range from about $100 to $1,000 and reimbursement rates from 70% to 90%, which lets you dial premiums up or down.nerdwallet+1

-

Pre‑existing conditions: Like most competitors, Spot excludes pre‑existing conditions, but some sources note that certain “curable” issues may be covered again after a symptom‑free waiting period if your vet verifies recovery.

Pros for dog owners:

-

Unlimited annual coverage available, which is important for expensive dog surgeries such as cruciate ligament repairs or cancer treatment.money+1

-

Strong marks for breadth of coverage (including many hereditary conditions that affect purebred dogs).nerdwallet+1

-

Highly flexible plan options, useful if you need to keep premiums at a certain budget.

Cons:

-

Premiums can be higher than bare‑bones “budget” providers when you choose low deductibles and unlimited cover.marketwatch+1

-

Some customers report that the level of customization can feel overwhelming if you’re brand new to pet insurance.

2. Lemonade – Best Value for Budget‑Friendly Dog Coverage

Lemonade stands out for fast, AI‑driven claims and competitive pricing, which is why it frequently appears as a “best value” or “budget‑friendly” pet insurer in 2026 roundups. It’s especially attractive if you already use Lemonade for renters or home insurance and want to bundle.cnbc+1

-

Typical cost for dogs: Often in the $25–$45 per month range for a healthy young dog on a basic accident‑and‑illness plan, sometimes lower than legacy carriers.joinkudos+1

-

Coverage highlights: Accidents, illnesses, diagnostic tests, medication, and optional packages for exam fees, dental illnesses, behavioral issues, physical therapy, and end‑of‑life care.

-

Technology & claims: Lemonade leans heavily on AI; many straightforward claims can be reviewed and approved within minutes via the app, making it one of the fastest options in the market.

Pros for dog owners:

-

Some of the lowest premiums among major brands for comparable coverage, according to 2026 buyer’s guides.cnbc+1

-

Very quick, app‑based claims process, handy when you’re juggling appointments and emergencies with your dog.

-

Easy digital experience end‑to‑end, including policy management and adding optional cover.

Cons:

-

Availability is still not nationwide in all U.S. states for every product, so you’ll need to check your zip code.

-

Some optional coverages (like exam fees or advanced therapies) require add‑ons, which can push the total price closer to competitors.

3. ASPCA Pet Health Insurance – Best for Broad, Simple Coverage

NerdWallet and regional guides such as NerdWallet’s California analysis frequently place ASPCA at or near the top of their rankings for overall value and breadth of coverage. It’s a strong pick if you want something straightforward that works with any licensed vet in the U.S.nerdwallet+1

-

Typical cost for dogs: Frequently quoted in the mid‑$40s to low‑$60s per month for accident‑and‑illness, depending on breed and location.

-

Coverage highlights: Accidents, illnesses, hereditary and congenital conditions, behavioral issues, alternative therapies, and optional wellness coverage.

-

Flexibility: Plans typically offer multiple annual limits, reimbursement levels (around 70%, 80%, 90%), and deductible options, giving you some room to tailor costs.

Pros for dog owners:

-

Very broad standard coverage, including some items that other providers only offer via add‑ons (such as behavioral issues in certain plans).nerdwallet+1

-

Works with any licensed vet in the U.S., which is convenient if you travel with your dog or relocate.

-

Strong overall scores in expert rankings for coverage and customer experience.marketwatch+1

Cons:

-

Some plans may have lower annual limits at the entry level, so you’ll want to choose higher limits if you’re worried about big dog emergencies.

-

Premiums can be slightly higher than rock‑bottom “budget” offerings once you add wellness or higher annual caps.

4. Pets Best – Best for Mobility Issues and Direct Vet Pay

Money and Forbes‑linked lists recognize Pets Best as a standout for treating mobility issues (e.g., cruciate ligament problems, hip dysplasia) and for offering direct vet payments, which can be a game changer during high‑cost dog surgeries.linkedin+1

-

Typical cost for dogs: Often among the lower quotes in comparison tables, with accident‑and‑illness coverage sometimes starting in the high‑$30s per month for younger dogs.

-

Coverage highlights: Accidents, illnesses, hereditary conditions, cancer, and optional routine care; many plans are friendly to dogs with orthopedic risks when enrolled before problems arise.

-

Direct vet pay: In some cases, Pets Best can pay participating vets directly, reducing the out‑of‑pocket burden for major procedures.

Pros for dog owners:

-

Very competitive pricing relative to coverage level, especially for active breeds prone to injuries.marketwatch+1

-

Short accident waiting period (often just a few days) so coverage kicks in quickly for new dog owners.

-

Direct vet pay option can help if you don’t have thousands of dollars available on a credit card at the time of surgery.

Cons:

-

Some customers report longer reimbursement times on traditional claims, especially during high‑volume periods.

-

Orthopedic conditions may have special waiting periods or limitations, so dog owners should read these sections carefully before enrolling.

5. Pumpkin – Best for Puppies and Young Dogs

Pumpkin is regularly labeled “Best for Puppies and Kittens” in 2026 roundups because it combines high reimbursement rates with wellness options that fit early‑life care. If you’re starting coverage when your dog is young, Pumpkin can provide robust protection before major conditions appear.

-

Typical cost for dogs: Often in the $45–$65 monthly range for accident‑and‑illness with a high (often 90%) reimbursement rate; puppies at low‑risk breeds may see lower premiums.

-

Coverage highlights: Accidents, illnesses, hereditary and congenital conditions, behavioral problems, and an emphasis on covering issues that commonly arise early in a dog’s life.

-

Wellness: Pumpkin promotes preventive care through optional wellness plans that help reimburse vaccines, annual exams, and other routine puppy services.

Pros for dog owners:

-

High reimbursement levels (often 90%) can greatly reduce out‑of‑pocket costs for large, unexpected puppy vet bills.

-

Designed with young pets in mind, which can lower the risk of exclusions for pre‑existing conditions if you enroll early.

-

Wellness add‑ons align with what most puppies need in the first year (core vaccines, deworming, microchipping).

Cons:

-

Premiums can be higher than some competitors when dogs reach middle age and older, especially at 90% reimbursement with generous limits.

-

Fewer low‑budget configurations than some “bare‑bones” providers, which can be a drawback if you strictly want the cheapest dog plan.

6. Embrace – Best for Healthy Pet Discounts

Embrace shows up in 2026 rankings as a top pick for its “Healthy Pet” discounts and flexible plan design, making it attractive if your dog rarely visits the vet. It’s also popular with multi‑pet households that want consistent coverage from a single provider.petinsurancereview+2

-

Typical cost for dogs: Commonly quoted in the mid‑$40s to $60s monthly for accident‑and‑illness plans, depending on breed, location, and deductible.

-

Coverage highlights: Accidents, illnesses, hereditary conditions, dental illness coverage to a specified limit, and optional wellness through the separate “Wellness Rewards” product.

-

Healthy Pet benefit: Embrace offers a diminishing deductible feature; your annual deductible can decrease in years when you don’t file claims, effectively rewarding healthy dogs.

Pros for dog owners:

-

Strong, broad coverage including many conditions (behavioral therapy, alternative treatments) that other insurers exclude or charge extra for.petinsurancereview+1

-

Diminishing deductible feature is very attractive if you have a healthy dog and want your deductible to shrink over time.

-

Widely available in the U.S., making it practical for dog owners who relocate or travel.

Cons:

-

Orthopedic issues like cruciate ligament problems may have longer waiting periods (e.g., several months) unless you get special vet exam waivers, which matters for large breeds.

-

Wellness is sold as a separate rewards plan, which can make the total monthly cost feel confusing to some buyers

7. Figo – Best for Flexible Reimbursement and Fast Claims

Figo appears in many top‑10 lists as a leading digital‑first insurer, praised for flexible reimbursement options and very fast claims processing. Its mobile‑centric approach appeals to dog owners who want everything handled via app.marketwatch+1

-

Typical cost for dogs: Frequently found in the mid‑$40s range for young dogs on standard accident‑and‑illness plans, with prices rising for certain breeds or higher reimbursement options.

-

Coverage highlights: Accidents, illnesses, hereditary conditions, cancer, and some alternative therapies; many plans allow you to choose reimbursement levels up to 100% in some states.

-

Tech & experience: Figo’s app streamlines claims submissions (photo uploads of invoices) and allows tracking statuses; some reviewers note accident claims being paid in just a few days.petinsurancereview+1

Pros for dog owners:

-

Very flexible reimbursement options, including high reimbursement tiers that significantly reduce out‑of‑pocket exposure for serious dog conditions.marketwatch+1

-

One of the faster digital claims experiences compared to more traditional carriers.

-

Often competitive pricing against other major brands at equivalent coverage levels.

Cons:

-

Wellness and some “extras” may not be as robust or may require add‑ons, depending on the state.

-

Some complaints mention occasional premium increases at renewal, which is not unique to Figo but worth monitoring.

8. AKC Pet Insurance – Best for Pre‑Existing Conditions

AKC Pet Insurance, associated with the American Kennel Club, is repeatedly cited by Money and other reviewers as a top choice for pre‑existing condition coverage under certain conditions, which is rare in this market. That makes it particularly interesting for purebred and registered dogs.pawlicy+1

-

Typical cost for dogs: Generally competitive with other mid‑range carriers, often in the $40–$60 monthly range depending on breed and plan; purebreds with known hereditary risks may be higher.

-

Coverage highlights: Accidents, illnesses, hereditary and congenital conditions, and optional wellness add‑ons; some plans are designed around breed‑specific risks like hip dysplasia or patellar luxation.pawlicy+1

-

Pre‑existing coverage: AKC offers a unique option where certain pre‑existing conditions may become eligible for coverage after a defined no‑symptom period, subject to underwriting, which is unusual among major providers.pawlicy+1

Pros for dog owners:

-

Especially appealing to owners of purebred dogs registered with the AKC who want a plan aligned with breed‑specific health risks.

-

Potential path to partial coverage for some pre‑existing conditions after waiting periods, which many competitors categorically exclude.

-

Discount incentives may be available for AKC‑registered litters or multi‑pet households.

Cons:

-

Some plans may have lower default annual limits than “unlimited” competitors unless you upgrade, so it’s important to read limit options.pawlicy+1

-

As with many niche offerings, coverage details can be more complex, and dog owners must review policy wording carefully to understand exactly which pre‑existing conditions can be reconsidered.

What Is Pet Insurance for Dogs?

Pet insurance reimburses vet costs for eligible treatments like surgeries, medications, and diagnostics. Dogs account for 80% of insured pets in the US, with 4.8 million covered in 2022 and growth at 22% annually.market+1

Plans cover accidents (e.g., broken bones), illnesses (e.g., cancer), and optional wellness (vaccines). Unlike human insurance, it’s not mandatory but saves thousands—average dog premiums hit $566 yearly.petnicki+1

How Much Is Dog Insurance in the USA?

Dog insurance costs $30–$100 monthly in 2026, averaging $50–$65 for accident-and-illness plans. Factors include breed (Bulldogs: $75+), age (seniors: $80+), location, and coverage.wsj+1

Accident-only starts at $10–$25; comprehensive with wellness reaches $120+. Young mixed breeds pay least ($30–$55).

| Coverage Type | Average Monthly Cost | What It Covers |

|---|---|---|

| Accident-Only | $10–$25 | Injuries, poisoning |

| Accident & Illness | $40–$70 | + Infections, chronic issues |

| Comprehensive + Wellness | $80–$120+ | + Checkups, dental |

This chart shows average premiums by breed for a 2-year-old dog. Brachycephalic breeds like Bulldogs cost more due to health risks.

Is Dog Insurance Mandatory in the USA?

Dog insurance is not mandatory anywhere in the USA. It’s regulated as casualty insurance in all states, with no legal requirement for pet owners.

Some rentals or breeders may suggest it, but liability for bites falls under homeowners’ policies. About 2–3% of 87 million US dogs are insured voluntarily.market+1

Real Scenario: A Labrador with cancer surgery ($8K) via Spot reimbursed 90% after $500 deductible, netting $600 out-of-pocket vs. full bill.

Buyer’s Guide: How to Choose Dog Insurance

Follow these steps for the best fit:

-

Assess Needs: High-energy breeds? Prioritize accidents/orthopedics.

-

Get Quotes: Compare 3+ via sites like Pawlicy Advisor—input breed/age/zip.

-

Check Coverage: Seek unlimited, exam fees, heredity (e.g., hip dysplasia).

-

Review Exclusions: Pre-existing (curable OK at Spot), waits (14 days illness).

-

Evaluate Claims: App-based (Figo: 2 days), direct pay (Pets Best).

-

Enroll Early: Lock rates before age 3; no upper limit but pricier.petpartners+1

-

Read Reviews: Reddit favors Trupanion for direct pay, but pricey.

Pro Tip: Bundle for discounts (Lemonade + home).

Frequently Asked Questions (FAQs)

What is the best dog insurance in the USA?

Spot tops for unlimited coverage and flexibility, per 2026 reviews.forbes+1

Does pet insurance cover spay/neuter?

Usually wellness add-on; Pumpkin includes $250/year.

Can senior dogs get insurance?

Yes, but higher premiums—no age cap at Embrace/Spot.

How fast are reimbursements?

2–5 days (Figo/Pets Best); up to 30 (some).wsj+1

Does it cover breeds like Bulldogs?

Yes, all breeds; higher rates for predispositions.petpartners+1

Is there a waiting period?

Accidents: 1–3 days; illness: 14 days; ortho: 6 months.

Worth it for healthy dogs?

Yes—locks rates, covers surprises (avg. claim $3K).

Final Thoughts

The best pet insurance companies for dogs USA like Spot and Pets Best balance cost and coverage amid rising 2026 vet expenses. Compare quotes now to safeguard your furry friend.